Payroll in Spain for US-Based Companies

It's a great time for US companies to hire global talent in Spain. Read our guide to learn more about payroll in Spain, including labor regulations, tax requirements, and more.

Caitlin MacDougall

Published on September 24, 2021

Pilot is now Plane!

Read Story →

A Redesigned Payments Experience

Read Story →

How to Choose a Remote Pay Strategy: The Complete Guide

Read Story →Spain is an optimal country in the European Union for setting up your US-based company's global team. The Spanish economy runs on a young and highly qualified workforce, and labor is relatively less expensive than in other countries in the EU. Another benefit to hiring in Spain is that the Spanish government provides incentives for foreign investment. It's a great time to be a foreign company looking to hire in this part of the European Union.If you're considering setting up an international team in Spain, there are important aspects to know about how payroll works abroad. In this article, we'll explore labor requirements in Spain, payroll in Spain, social security requirements, and more.First, you will need to know what type of worker you want to hire, as there is a difference between how labor laws and payroll tax works for independent contractors versus employees. Tax authorities and labor authorities do conduct inspections, and you don't want to be subject to fines for not being in compliance.Here are guidelines for understanding the main types of workers:

Employees

In employment contracts, employees are subordinate workers, meaning the employers have control over managing the employee's schedule, and determining where the employee will work and what tools or equipment the employee will use.Standard Labor Laws for Employees ⚖️

Collective agreements in Spain ensure that employees are entitled to the standards of employment law such as minimum wage, which is €1,108 gross per month in Spain. Employers are also required to remit severance pay for employee termination, as well as overtime should the employee work longer than the typical working day. Under collective bargaining agreements, an employee's working hours must not exceed 40 per week, and they are limited to 9 hours a day. The employer must provide 12 hours of rest between working days.Siestas are not a part of official labor law, but they are still part of Spanish culture. Siestas are three-hour periods of rest, typically after a midday meal in some of the warmer regions of the world. Although the rest period is a cultural hallmark of Spain, these days it may be seen practiced more commonly in rural areas. Overall, more and more people are cutting their afternoon breaks short.Other benefits such as paid leave, maternity leave and paternity leave, leave for jury duties, or sick leave must be provided by the employer.Compensating Employees in Spain 💰

Employees must be paid a monthly salary, or a more frequent salary, depending on the labor contract or collective bargaining agreements. All the payments are required to be made with a check or direct bank deposits. If an employer pays an employee by check, then the employer has to provide the employee with a pay slip that shows the withholding tax and social security payment taken out of each paycheck. Late payments to an employee can result in interest at a 10% annual rate.Independent Contractors 🧑

Workers who are self-employed in Spain (autónomo), work with little oversight from an employer. An employer pays the self-employed or independent contractor, but they are not required to provide benefits such as overtime, vacation time, health insurance, or maternity leave or paternity leave.Additionally, a contractor is not entitled to things like severance pay if an employer ends their contractual relationship with them. On the upside for contractors, they have much more autonomy than the average worker: they can use their own equipment to provide a service, and aren't necessarily required to work at the physical office of the company. Independent contractors arrange their own hours, and charge their own rates.Income tax and social security requirements

It's up to the independent contractors to have their own tax ID number and to pay their own personal income tax and social security to the tax agency. Independent contractors must register their income and expenses on a quarterly basis. Many employers seek independent contractors because they can circumvent additional payments in payroll taxes, and they are not responsible for registering their team members with the social security office. Despite the tax headache, most independent contractors enjoy having the ability to work for themselves.Spanish payroll tax and social security contributions for employees 💶

A Spanish company must split the share of withholding taxes with their employee. Withholding tax is the amount of federal income tax that is withheld from an employee's gross salary. In addition to withholding taxes, employers must pay a share of social security with their employees. While employers are typically subject to corporate income tax, branch profits tax, and value added tax (VAT), they are also responsible for capital tax, transfer tax, real property tax, withholding tax, and other taxes mandated by local governments. The annual filing deadline for tax returns is June 30.As mentioned, employment is strictly regulated in Spain. A company must register their employees with the proper tax office and social security office to be in compliance with labor law.Permanent and temporary contracts 📃

The rules of Spain income tax may vary depending on the employment contract. In the case of a permanent contract, it is assumed that the employee is working indefinitely with the company or on an open-ended term. A temporary employment contract must be in writing.Temporary employees can be hired under these circumstances:- contract is for a specific service

- contract for production contingencies: these contracts may not exceed 6 months within a 12 month period. If the temp works beyond six months, they are considered a permanent employee.

- temporary replacement: the employer must identify the employee being replaced and the reason they were replaced

Payroll tax

In general, employers cover most of their employee's withholding tax. Normally, companies use PAYE (Pay As You Earn) plans, which withhold a certain amount of income per pay period for tax purposes.For an employer, their employee's unemployment benefits average to 5.5% of the employee's gross annual salary, whereas the employee only pays 1.55% in income taxes. The taxes for professional training requires that employers pay .60% in contributions and employees pay .1%.Companies must pay a corporate income tax (CIT) to the tax office during the first 20 calendar days of April, October, and December. The final CIT payment must be made with the annual CIT return.All told, the employer pays 29.9% in taxes to employ a worker, and the employee pays 6.7% in taxes. Depending on your company’s circumstances, there may also be the need for additional employer-side taxes, such as third-party liability insurance and work injury insurance.13th and 14th salary

Similar to countries in Latin America, Spain requires bonus salaries to be paid to their employees twice during the year. These are called 13th and 14th salaries. Many collective agreements include 13th and 14th salaries, which are due respectively by July 10 and December 15. These bonus payments are commonly pro-rated over 12 payments, however, it varies depending on the company’s collective agreement and their employee's salary. If an employee would prefer to be paid over the course of 12 months, they would need to sign a statement indicating this and file it with the company's payroll provider.Social security contributions

To hire an employee in Spain, an employer must enroll their employee with social security authorities to register within the general social security system, known as Tresorería General de la Seguridad Social (TGSS), where the employee will be permanently registered for life. Contributions represent the public insurance system, and may vary: there is a special tax regime for workers who serve in the military or are considered civil servants, but typically most are registered with a general plan. To receive benefits such as sick leave, maternity or paternity leave, compensation for accidents that occur at work, and unemployment, the employee must pay social security taxes to the Spanish government.The employee contribution rate for social security and other benefits is a lot lower than that of their employers. The employer and the employee split up social security contributions so that the employer pays 23.6% and the employee pays 4.7%. The employer also must pay taxes to a salary guarantee fund (.20%), while an employee is not required to contribute to this fund.Spain withholding tax and social security contributions for independent contractors

The tax laws are very different for independent contractors, and, as mentioned earlier, technically there is no payroll tax for them. Independent contractors file taxes independently; the employer is not responsible for withholding a portion of the contractor's income. The requirements for self-employed workers' income tax and social security is known as régimen especial trabajadores autónomos, which directly translates to "special regime for self-employed workers."Withholding tax

A self-employed worker's income tax ranges from 19% to 45% of their salary, depending on their annual income and tax laws within the region where they live. It is wise for a contractor to withhold a portion of their income and pay their taxes incrementally over the course of a year to avoid having to pay a large amount in one lump sum.Social security contributions

If a freelance worker is working for more than minimum wage, they usually pay more self-employment tax than regular employee income tax, and in order to receive benefits like healthcare, they must pay for social security.Remote Payroll

Now that we have covered payroll taxes, let's get into the practicalities of paying your company's workers, particularly those you hired internationally.Registering a foreign business to administer payroll

International payroll applies to foreign companies that wish to hire and pay workers outside of the country where they are established. Global payroll services provide a foreign business with a system to pay foreign employees, as well as international contractors.For payroll in Spain, you do not need a legal entity established to process your company's payroll. If you have a non-resident company or a well established business outside of Spain, and do not plan to have a permanent establishment in the country, you must register your foreign business with the social security office in Spain.First, you will need to request a CIF, or “no residente sin Establecimiento permanente,” which is a tax ID for a non-resident company without permanent establishment. You can then register your US company's employees in Spain with the social security office.Data Security 🔒

Payment security should not be taken lightly, and it's important to know that your payroll is administered securely. According to Risk Based Security’s 2020 Year End Report on data breaches, there were 3,932 breaches reported in 2020, with 37 million exposed records last year. Without security measures in place, your company may be vulnerable to ransomware.And this isn't a problem that's specific to the United States. If you're looking to hire internationally, whether it be in Spain or anywhere else, cyber attacks can become an even bigger risk. Remember SolarWinds? You never want to compromise your company's security, especially if it's in its nascent stages.Legal Disclaimer:

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

Outsourcing your company's global payroll and payments

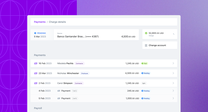

Working with a platform like Pilot is a great way to ensure you're paying your global team members in a secure and compliant way. Pilot enables US-based companies to onboard and pay workers securely from anywhere around the world. Pilot is SOC 2 compliant and can help your business with not only international payroll, but we can also assist with labor and tax compliance, and providing benefits to your global team members.Pilot offers optimal exchange rates and no markups on payments to your global contractors. Typically, when working with other payment methods such as wire transfers, companies can encounter prohibitively high international wire fees for both the company and the contractor. These fees can be as high as $50 USD to send a single international wire, and as for the worker, they may need to pay as much as $25 to receive the wire. Let's invent a scenario with this rate: say your company has hired 40 contractors abroad, and you pay them monthly. If you had to submit a $50 fee each time they were paid, that would amount to $600 per contractor a year. For 40 contractors? The cost would total $24,000--yikes. And you would be hard pressed to find a contractor who would be willing to pay $300 of their annual salary to these banks, on top of their own tax requirements!As countries are becoming increasingly interested in hiring remotely, your business is well-positioned to hire talent abroad. Pilot's platform ensures that you have one less thing to worry about. Even better, your workers will get the most out of their paychecks with Pilot's optimal exchange rates.Going global isn't daunting when you partner with Pilot. 🤝

Book a FREE, no-obligation demo with one of our experts now.

Schedule a demoRelated articles

From startups to large corporations, US companies of all sizes use Pilot for international payroll, benefits and compliance.

Unified Payroll is fully launched!

New customers now have access to Unified Payroll, as well as new HRIS features, onboarding enhancements, and vendor management.