Managing Contractor Compliance With an International Team

Learn best practices when it comes to international contractor compliance, to help you save time, save money (for both you and your contractors), and build strong relationships with your global team members.

Plane Team

Published on October 1, 2021

Pilot is now Plane!

Read Story →

A Redesigned Payments Experience

Read Story →

How to Choose a Remote Pay Strategy: The Complete Guide

Read Story →Hiring international contractors is a great way to tap into a bigger talent pool. But it involves more than posting a job description, interviewing, and making a hire. When you’re expanding abroad, it’s crucial to prioritize contractor compliance. Being proactive about compliance as you expand internationally will help you steer clear of trouble no matter where you do business. It can also save you time and money and preserve your relationships with your contractors. Here’s what you need to know about international contractor compliance so that legal fees, delayed payments, transaction fees, and more don’t get in the way of working with talent abroad.

Steer Clear of Process Problems and Administrative Headaches

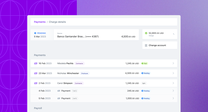

Employees and contractors may be classified differently, but that doesn’t mean you need a dramatically different approach to managing them. This applies to getting contractors onboarded in a timely and smooth manner, making sure they’re paid on time, and prioritizing the most seamless payment method possible.Tax forms and contract requirements vary by country, but your approach to paying each contractor shouldn’t. Especially when forms require multiple approvals and signatures, things can get delayed quickly. That’s why we recommend giving your paperwork a digital makeover and migrating international contractor forms to a centralized place — one that’s accessible by every person that needs to sign off before work can begin. Streamlining is the name of the game for paying contractors, too. Odds are, you don’t manage employee payroll manually. With so much on your plate, that would take up valuable time every two weeks. But do you also automate payments for contractors? Even if invoice amounts vary month to month, you can still have a minimalist approach to sending payments. With Pilot, it works like this:- You set up ACH payments from a US-based bank account

- You select the frequency and currency for payments in over 240 countries, with local currency payments and bank transfers supported in over 70 countries (meaning no cost for your contractors)

- Your contractors can see the status of payments and even manage their own payment details so that there are no surprises

Don’t (Accidentally) Make Contractors Pay to Work for You

Speaking of creating a smooth process, we need to talk about a common pain in the world of international payments: fees. Transferring money from PayPal to a contractor’s bank account isn’t the only challenge with e-wallets. They also need to choose whether they want to pay a fee for an instant transfer or wait several days for the money to appear in their account. Plus, there are transfer fees for the receiver for international payments that involve currency conversions. While the e-wallet fees we mentioned above are an avoidable nuisance, wire transfer fees are expensive by any definition of the word. Of course, you want to pay your contractor the amount you agreed upon at the start of a project. But if you choose to send the money via wire transfer, you could inadvertently be paying them less — as much as $25 USD less per transfer in some cases. Not to mention fees as high as $50 per transfer for your own company. A better way? Sending payments directly to a contractor’s bank account in their currency ... without using a hodgepodge of different payment processors and banks. It’s not just about money, either. It’s about loyalty. Especially in the past year and a half, many companies have realized the benefits of hiring workers anywhere in the world. That’s great news for international contractors, but it’s also a reason to give them a great experience so they’ll stick around for years to come.Know the Limits of Your Legal Expertise

Working with international contractors is a common practice these days (a whopping 73% of US-based companies send international payments). If you’re part of that 73% and don’t have extensive legal expertise in-house, outsourcing to the pros is a smart move. Plus, no two countries are exactly the same when it comes to doing business. For each country where you work with independent workers, you’ll have to tread carefully with — and keep up with — contractor compliance. What sort of trouble could you encounter if you don’t work with a local legal pro? Here’s an example: In the UK, there’s legislation in place to ensure companies do not hire a contractor to get the tax benefits but assign them work as if they’re an employee. Violating this will fall on you as the employer, not your contractor. If you’re caught doing this (even if it’s by mistake), the evaded taxes will fall on your business. And in France and Spain, your company needs to give contractors benefits and withhold taxes from their payroll — as if they’re full-time employees. If you don’t do this and a contractor takes legal action, you’ll likely become responsible for paying those benefits, and the contractor will be switched to an employee.When it comes to local contractor compliance, everything from worker classification to local taxes to IP transfer laws can be different from one country to the next. That can quickly add up to a lot of decisions and a lot of paperwork you’re not prepared to handle. Though your company may be small and want to bootstrap, this is one case where in-house isn’t best. If you don’t work with a lawyer trained in local payment laws for each country where you work with contractors, there are bound to be tax and legal-related issues in your future. Even if contractor laws never changed, it’s too much for a business owner or small HR team to keep up with alone, without the help of a legal expert well-versed in the contractor laws of each country. Especially when a single oversight can have serious consequences. We know you don’t have days of free time to onboard new contractors, and you may not have the budget for the legal fees for that, either. Streamlining all of this on a single platform means you’ll have a legal team at your disposal, making sure you properly adhere to local laws and save time and money in the process.It isn’t just about staying out of trouble, either. Legal issues can delay starting work with contractors and delay them getting paid, too. Getting this right from the beginning will benefit everyone involved.Legal Disclaimer:

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

Contractor Compliance Doesn’t Have to Be Overwhelming

If you’re responsible for hiring, you can’t escape the world of compliance. While you may already be a pro at compliance for your US-based team members, if you’re hiring overseas contractors, you’ll need help navigating all the nuances involved. When you work with Pilot, we’ll be your trusted partner in international compliance and more. We’ll help you:- Feel confident that you’re adhering to local compliance, from forms and filings to contracts and worker classification

- Set up payments to more than 240 countries, with local currency payments and bank transfers supported in over 70 countries

- Make invoicing a transparent process so that your contractors always know when to expect payments

- Avoid e-wallet frustrations and expensive international wire fees

- Get all your questions answered with access to local HR and legal experts

Going global isn't daunting when you partner with Pilot. 🤝

Book a FREE, no-obligation demo with one of our experts now.

Schedule a demoRelated articles

From startups to large corporations, US companies of all sizes use Pilot for international payroll, benefits and compliance.

Unified Payroll is fully launched!

New customers now have access to Unified Payroll, as well as new HRIS features, onboarding enhancements, and vendor management.