Canada Employment Laws: A Guide for US Companies

With its close proximity, growing tech industry, and plethora of English speakers, Canada is an ideal place for US companies to hire remote workers. We walk through the key employment laws to keep in mind if you're hiring there.

Caitlin MacDougall

Published on March 5, 2022

Pilot is now Plane!

Read Story →

A Redesigned Payments Experience

Read Story →

How to Choose a Remote Pay Strategy: The Complete Guide

Read Story →Canada is a great location to hire remote workers if you're a US company looking to build an international team. Because of its proximity, scheduling calls, meetings, and interviews are easy and convenient. Plus, there is little language barrier: the majority of the country speaks English, or a combination of English and French.Canada's popular industries include aerospace, design, and tech. In fact, there has been what is known as "brain gain" in Toronto in recent years: a study in 2021 reported that Toronto had attracted 81,200 tech jobs and produced 26,338 tech degrees, which created a total of 54,862 tech workers.While Canada is certainly an appealing place to hire a remote team, you should familiarize yourself with employment laws in Canada before you start the hiring process. Let's start with employee classification.

Employees versus independent contractors 👩💻

Different companies will require different types of workers. Canada has a system for determining whether a worker is an employee or an independent contractor (i.e., self-employed); depending on the worker classification, your obligations to that worker will vary. Here is a guideline for understanding different types of workers and those workers' rights.Employees

Hiring employees can be helpful if your company needs to work collaboratively on an ongoing project, or if the company can provide an indeterminate amount of work. In an employer-employee relationship in Canada, the employer has more oversight over the employee's work. The employer:- manages the employee's schedule

- instructs the employee on their duties.

- provides the tools the employee needs to do their job

- handles the employee's income tax and social security contributions

- grant employees minimum vacation time

- provides severance pay when the employee's employment ends (minimum payment is five days' wages)

Independent Contractors

An independent contractor is considered self-employed. While a contractor receives compensation for their work just as an employee would, the employment standards when working with a contractor are very different from those of an employee.There is much less oversight from employers over a contractor's work. When working with independent contractors, the employer may not:- manage the independent contractor's schedule

- instruct the independent contractor on how they are to complete their duties

- provide the tools needed for the job

Employment Standards legislation ⚖️

If your company plans to hire Canadian employees, keep in mind that an employer-employee relationship and the labor standards therein will depend on the province where your employee lives.Employment law, known as employment standards legislation, will vary according to province. There are ten provinces and three territories in Canada, including Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Québec, and Saskatchewan.Québec's employment standards tend to vary the most from other provinces. Minimum standards in Québec are known as Act respecting labour standards, and like many of Québec's laws, the labor standards are based on civil law in Europe. A province like Ontario has labor laws that are influenced by British common law. Their labor standards are known as Employment Standards Act (ESA). Both sets of laws in Québec and Ontario address minimum wage requirements, termination of employment, vacation and parental leave, etc.Minimum wage and overtime pay ⏰

Minimum wages will vary according to province. At present, Ontario's minimum wage is $15.00 Canadian dollars an hour. As of 2022, Québec's minimum wage will rise from CA$13.50 an hour to $14.25 an hour. In British Columbia, the province of Vancouver, the minimum wage is CA$15.20 an hour. Nunavut has the highest minimum wage in Canada, at CA$16.00 an hour.Overtime laws will also depend on the province. Generally, any hours that exceed 40 to 44 per week are considered overtime hours. The rate for overtime is 1.5 times an employee's regular wages, and while some laws differ on overtime qualifications, any employee — whether salaried, hourly, or on commission — can earn overtime.Collective bargaining

Collective bargaining disputes are handled by the Federal Mediation and Conciliation Service. Not only does the federal government group assist with employment-related claims, but it also prevents disputes between trade unions and employers. Usually, a mediator and third party is necessary to help both parties reach a mutual agreement.Canadian Human Rights Act

The Canadian Human Rights Act is a country-wide law that is designed to prevent discrimination based on an employee's:- age

- race

- nationality

- ethnicity

- color

- religion

- sex

- sexual orientation

- gender identity or expression

- marital status

- family status

- genetic characteristics

- disability

- offense for which a pardon has been granted

Employment Equity Act

Four designated groups are protected under the Employment Equity Act (EEA) in Canada: women, people with disabilities, Aboriginal people, and visible minorities. The purpose of the EEA isn't just about equal treatment, but also equity: the law ensures that Canadian employers provide special measures and accommodations for these four designated groups, including measures that also improve these groups' employment opportunities.Occupational health and safety laws ⛑

The Canada Labour Code requires that Canadian employers notify any employees of potential hazards in the workplace. This part of the Code applies to these industries:- railways

- highway transport

- telephone and telegraph systems

- pipelines

- canals

- ferries, tunnels and bridges

- shipping and shipping services

- radio and television broadcasting and cable systems

- airports

- banks

- grain elevators licensed by the Canadian Grain Commission

- certain feed mills and feed warehouses, flour mills, and grain seed cleaning plants

- the federal public service and persons employed by the public service

- employment in the operation of ships, trains and aircraft

- employment related to the exploration and development of oil on federal lands

Parental leave 🤰

Mothers (including biological, adoptive, or foster mothers) are entitled to a maximum of 15 weeks of paid time off after giving birth or taking a child into their home. Any parent of a newborn, newly fostered, or newly adopted child has two options for parental leave: standard parental benefits and extended parental benefits.Standard parental benefits include a maximum of 35 weeks of paid time off at 55% of the claimant’s average weekly wages earned; Extended benefits allow a maximum of 61 weeks of paid time off at a rate of 33% of the employee's average weekly earnings. For standard parental benefits, a parent can take this leave any time within a 52-week period after a child is born, fostered, or adopted. For extended benefits, the leave must be taken within 78 weeks after the child is born, fostered, or adopted.Sick days 🤒

Canadian employers must provide five days' sick leave for their employees for each calendar year that worker has been employed. An employee is entitled to three paid days' sick leave after three consecutive months of employment.Employees can also use sick days to care for family members, or in the case of a family emergency. If they need more leave for family emergencies, they may use their annual vacation entitlement.Vacation entitlement 😎

Federally regulated businesses must provide their employees with a minimum of 2 weeks of annual vacation after completing twelve consecutive months of service, a measurement known as the "year of employment" with the same employer. After five consecutive years of employment with the same employer, this benefit increases to three weeks of annual vacation.Holidays

If an employee asks for a vacation, the employer will schedule vacation time based on a mutually agreed upon time period. The Canada Labour Code (the Code) requires employers to provide holiday pay for their employees 10 times per year for public holidays.Many of the holidays in Canada are the same as in the US: religious holidays, such as Good Friday and Christmas Day will be celebrated on the same day, but some holidays in Canada have a different calendar date than those in the US. Thanksgiving in Canada, for instance, falls on the second Monday in October, whereas US Thanksgiving is the fourth Thursday in November.Disconnecting from work (Ontario) 🔕

In light of the COVID-19 pandemic and the rise of remote work, many countries and territories are adjusting their employment standards with special rules for telework. In Ontario's ESA, if a business employs 25 or more employees on January 1 on any given year, they must have a written policy on disconnecting from work in place by March 1 of that year. This bill is known as Bill 27, or the Working for Workers Act. While its intended purpose is to prevent workers from communicating with their employers outside of working hours, practically speaking, it only requires that employers communicate their expectations for disconnecting from work. If you are hiring in Canada, your disconnecting-from-work policy should be outlined in an employee agreement.Termination and severance pay 💰

If an employer wishes to dismiss an employee, they can provide an employee with two weeks' written notice. In lieu of working notice, the employer must provide a lump sum of two weeks' worth of wages.An employee who has completed at least 12 consecutive months of continuous employment qualifies for severance pay, except in certain circumstances. For instance, when an employment contract has a specific end date, or when an employee is dismissed for just cause, severance pay is not required.Severance is also not required when a lay-off does not result in a termination. A lay-off as a result of a strike, for instance, would be one circumstance in which an employee's lay-off does not end in termination of employment because it is a temporary lay-off.If a lay-off is three months or less, or if the period of the lay-off is more than three months but less than 12, the employee maintains their recall rights in from a collective agreement.Staying compliant with employment law

Federal law regarding employee standards and employee rights can be complex, and it's hard to keep track of all the details of employment laws in different countries if you're not an expert. Canada can be an especially tricky country to navigate, with different sets of rules governing different provinces.Fortunately, partnering with a company that specializes in global HR and compliance is an option for companies that need to stay organized as their business grows internationally.Legal Disclaimer:

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

How Pilot can help 🤝

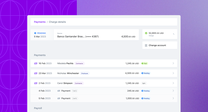

Partnering with Pilot can help your company stay compliant in other countries. Pilot's serves as an employer-of-record (EOR) for hiring employees, and as a payroll platform for hiring contractors. With our expert advice, a US company can avoid expensive penalties or legal fees for overlooking critical labor laws.Not only do we specialize in international compliance, but we also provide global payroll and benefits expertise for US-based companies. When it comes to payroll, we never mark up exchange rates, and contractors love us because unlike other payroll platforms, we don't require payees to use a debit card or e-wallet to access their funds. Instead, funds go straight to the contractors’ bank accounts. Even better, we support payments in over 240 countries around the world, which allows more hiring flexibility as you grow your international team of remote workers.Pilot wants you to be able to focus on the vision and growth of your business, because we know your job is more than just payroll and compliance.Interested in learning more about Pilot? Schedule a demo with one of our experts.Going global isn't daunting when you partner with Pilot. 🤝

Book a FREE, no-obligation demo with one of our experts now.

Schedule a demoRelated articles

From startups to large corporations, US companies of all sizes use Pilot for international payroll, benefits and compliance.

Unified Payroll is fully launched!

New customers now have access to Unified Payroll, as well as new HRIS features, onboarding enhancements, and vendor management.